Harvest Time

Whatever it is that you may have sown,

we'll give you the power to reap GOLD. 1-800-869-5115

USAGOLD-Centennial has three decades of experience in the field

All times are U.S. Mountain Time

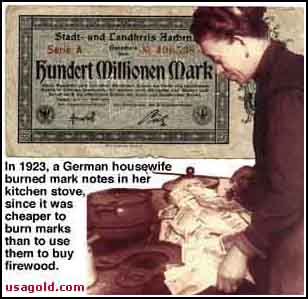

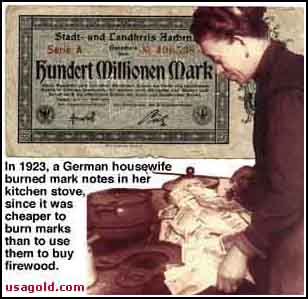

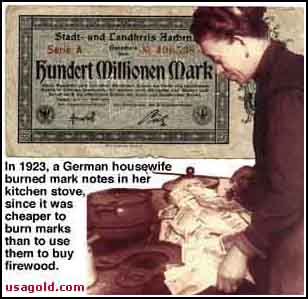

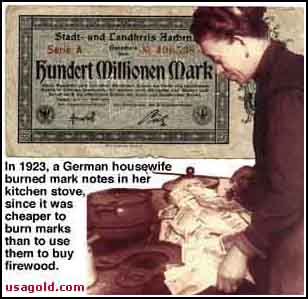

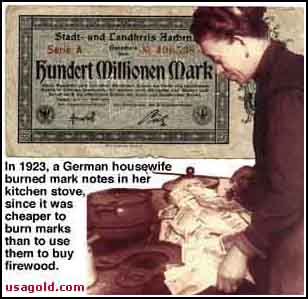

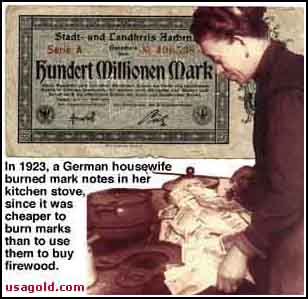

A picture may be worth a thousand words,

A picture may be worth a thousand words, A picture may be worth a thousand words,

A picture may be worth a thousand words, A picture may be worth a thousand words,

A picture may be worth a thousand words, A picture may be worth a thousand words,

A picture may be worth a thousand words, "Without waxing philosophical, a few words are helpful concerning the mind-set with which you pursue your interest in gold ownership. Some enter the gold market to make a profit, others to hedge disaster, some to accomplish both. No matter into which category you fit, make sure you understand why you are going into the gold market. Convey that understanding to the individual with whom you are structuring your gold portfolio. The whys have quite a bit to do with what you end up owning.

"Without waxing philosophical, a few words are helpful concerning the mind-set with which you pursue your interest in gold ownership. Some enter the gold market to make a profit, others to hedge disaster, some to accomplish both. No matter into which category you fit, make sure you understand why you are going into the gold market. Convey that understanding to the individual with whom you are structuring your gold portfolio. The whys have quite a bit to do with what you end up owning.

"Frequently investors will say that any kind of gold will do because after all gold is gold, isn't it? This type of attitude has helped a great many coin shop owners unload unwanted inventory they hadn't been able to get rid of for years. This is probably a good deal for the coin dealer, but it could spell disaster for you. In the same vein, I have talked to hundreds, probably thousands, of investors in nearly a quarter century in the business. Quite often, potential investors have no more reason for buying gold than 'everybody else is doing it.'

"In Chapter 16 on portfolio planning, you will find some details on this important subject. For now, consider the inscription over the entrance to the temple of the ancient Delphic Oracle: 'Know Thyself.' Study. Read. Learn what's going on around you. Call a few gold firms and ask questions. There's nothing like conversation to stimulate thinking. Take time to lay a little groundwork. Then make your move. The political and economic situation being what it is, there is no better time to start than now. Know thyself -- your goals and needs -- and you will be a more confident, happier gold investor." (more)

Please Remember: It is your purchase from USAGOLD - Centennial Precious Metals that nourishes these pages.

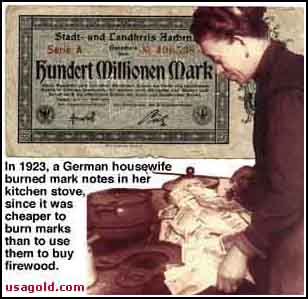

A picture may be worth a thousand words,

A picture may be worth a thousand words, A picture may be worth a thousand words,

A picture may be worth a thousand words,MK & Gandalf the White (6/14/04)

TA TA TAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA

YES, ALL -- Those were the CONTEST trumpets sounding again! A call to contest! A call to contest!

Knights and Ladies, consider this:

This month's National Geographic is preparing the public for the worst when it prints,

"Think gas is expensive now? Just wait. You've heard it before but this time its for real: We're at the beginning of the end of cheap oil."

Thanks to Sir Black Blade and others, we at the Table Round knew that someday this would be published to all ---

BUT, now let's take that a step further.

What will the end of cheap oil mean as a permanent state of affairs for the U.S. economy? For the world economy? What will it mean for gold?

So we'll make this a contest at two levels.

First, and most important, an "Essay Contest" answering the questions posed above. For the Essay entry, please indicate in the subject box as follows:

**** The End of Cheap Oil ****

(Just like that, surrounded by stars)

To qualify for contest entry, the Essay should be fifty or more words in length.

Essay Entry Deadline: NOON Denver time on Friday, June 25, 2004.

AND, YES, a Second Contest segment -- a gold price-guessing contest with STATEMENT!!!

The winner will be the entry closest to the settlement of the August futures contract (GC4Q) on the COMEX for Friday, June 25, 2004. All entries must be in Dollars and Tenths, posted by 12:00 Midnight Mountain time at the end of day, Tuesday, June 22, 2004.

Please indicate your POG Contest entry in the message subject box as follows:

$$$$Gold Price Guess$$$$

SUCH AS ---

$$$$$$$432.1$$$$$$$$

ALSO, --- Each POG guess must be accompanied by a brief statement on WHY you think gold is going to go where you think it is going.

=====

The following prizes, donated by Centennial Precious Metals, will be awarded.

For the Essay Contest

First prize is a highly collectible United States $10 gold Liberty coin in uncirculated grade, (0.48375oz. net fine gold)

Second prize is a Uruguay 5 peso gold coin (0.2501 net fine gold oz)

Third prize: A one ounce U.S. Silver Eagle.

===

For the GOLD Price-Guessing Contest

First prize is a Uruguay 5 peso gold coin (0.2501 oz. net fine gold)

Second and Third prizes shall be one each, a U.S. Silver Eagle.

On with the CONTEST and onward toward the prizes!! Good luck to all!!

For a new window to post your contest entry to the forum, click here. (Post a New Message)

What?! You don't have a password yet??! It couldn't be easier. Please review our Discussion Forum Guidelines page where you may register for your password. COME AND JOIN IN ON THE FUN ALL you lurkers!!

Gandalf the White

TA TA TAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA

YES, ALL -- Those were the CONTEST trumpets sounding again! A call to contest! A call to contest!

Knights and Ladies, consider this:

This month's National Geographic is preparing the public for the worst when it prints,

"Think gas is expensive now? Just wait. You've heard it before but this time its for real: We're at the beginning of the end of cheap oil."

Thanks to Sir Black Blade and others, we at the Table Round knew that someday this would be published to all ---

BUT, now let's take that a step further.

What will the end of cheap oil mean as a permanent state of affairs for the U.S. economy? For the world economy? What will it mean for gold?

So we'll make this a contest at two levels.

First, and most important, an "Essay Contest" answering the questions posed above. For the Essay entry, please indicate in the subject box as follows:

**** The End of Cheap Oil ****

(Just like that, surrounded by stars)

To qualify for contest entry, the Essay should be fifty or more words in length.

Essay Entry Deadline: NOON Denver time on Friday, June 25, 2004.

AND, YES, a Second Contest segment -- a gold price-guessing contest with STATEMENT!!!

The winner will be the entry closest to the settlement of the August futures contract (GC4Q) on the COMEX for Friday, June 25, 2004. All entries must be in Dollars and Tenths, posted by 12:00 Midnight Mountain time at the end of day, Tuesday, June 22, 2004.

Please indicate your POG Contest entry in the message subject box as follows:

$$$$Gold Price Guess$$$$

SUCH AS ---

$$$$$$$432.1$$$$$$$$

ALSO, --- Each POG guess must be accompanied by a brief statement on WHY you think gold is going to go where you think it is going.

=====

The following prizes, donated by Centennial Precious Metals, will be awarded.

For the Essay Contest

First prize is a highly collectible United States $10 gold Liberty coin in uncirculated grade, (0.48375oz. net fine gold)

Second prize is a Uruguay 5 peso gold coin (0.2501 net fine gold oz)

Third prize: A one ounce U.S. Silver Eagle.

===

For the GOLD Price-Guessing Contest

First prize is a Uruguay 5 peso gold coin (0.2501 oz. net fine gold)

Second and Third prizes shall be one each, a U.S. Silver Eagle.

On with the CONTEST and onward toward the prizes!! Good luck to all!!

For a new window to post your contest entry to the forum, click here. (Post a New Message)

What?! You don't have a password yet??! It couldn't be easier. Please review our Discussion Forum Guidelines page where you may register for your password. COME AND JOIN IN ON THE FUN ALL you lurkers!!

Gandalf the White

TA TA TAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA

YES, ALL -- Those were the CONTEST trumpets sounding again! A call to contest! A call to contest!

Knights and Ladies, consider this:

This month's National Geographic is preparing the public for the worst when it prints,

"Think gas is expensive now? Just wait. You've heard it before but this time its for real: We're at the beginning of the end of cheap oil."

Thanks to Sir Black Blade and others, we at the Table Round knew that someday this would be published to all ---

BUT, now let's take that a step further.

What will the end of cheap oil mean as a permanent state of affairs for the U.S. economy? For the world economy? What will it mean for gold?

So we'll make this a contest at two levels.

First, and most important, an "Essay Contest" answering the questions posed above. For the Essay entry, please indicate in the subject box as follows:

**** The End of Cheap Oil ****

(Just like that, surrounded by stars)

To qualify for contest entry, the Essay should be fifty or more words in length.

Essay Entry Deadline: NOON Denver time on Friday, June 25, 2004.

AND, YES, a Second Contest segment -- a gold price-guessing contest with STATEMENT!!!

The winner will be the entry closest to the settlement of the August futures contract (GC4Q) on the COMEX for Friday, June 25, 2004. All entries must be in Dollars and Tenths, posted by 12:00 Midnight Mountain time at the end of day, Tuesday, June 22, 2004.

Please indicate your POG Contest entry in the message subject box as follows:

$$$$Gold Price Guess$$$$

SUCH AS ---

$$$$$$$432.1$$$$$$$$

ALSO, --- Each POG guess must be accompanied by a brief statement on WHY you think gold is going to go where you think it is going.

=====

The following prizes, donated by Centennial Precious Metals, will be awarded.

For the Essay Contest

First prize is a highly collectible United States $10 gold Liberty coin in uncirculated grade, (0.48375oz. net fine gold)

Second prize is a Uruguay 5 peso gold coin (0.2501 net fine gold oz)

Third prize: A one ounce U.S. Silver Eagle.

===

For the GOLD Price-Guessing Contest

First prize is a Uruguay 5 peso gold coin (0.2501 oz. net fine gold)

Second and Third prizes shall be one each, a U.S. Silver Eagle.

On with the CONTEST and onward toward the prizes!! Good luck to all!!

For a new window to post your contest entry to the forum, click here. (Post a New Message)

What?! You don't have a password yet??! It couldn't be easier. Please review our Discussion Forum Guidelines page where you may register for your password. COME AND JOIN IN ON THE FUN ALL you lurkers!!

Gandalf the White

TA TA TAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA

YES, ALL -- Those were the CONTEST trumpets sounding again! A call to contest! A call to contest!

Knights and Ladies, consider this:

This month's National Geographic is preparing the public for the worst when it prints,

"Think gas is expensive now? Just wait. You've heard it before but this time its for real: We're at the beginning of the end of cheap oil."

Thanks to Sir Black Blade and others, we at the Table Round knew that someday this would be published to all ---

BUT, now let's take that a step further.

What will the end of cheap oil mean as a permanent state of affairs for the U.S. economy? For the world economy? What will it mean for gold?

So we'll make this a contest at two levels.

First, and most important, an "Essay Contest" answering the questions posed above. For the Essay entry, please indicate in the subject box as follows:

**** The End of Cheap Oil ****

(Just like that, surrounded by stars)

To qualify for contest entry, the Essay should be fifty or more words in length.

Essay Entry Deadline: NOON Denver time on Friday, June 25, 2004.

AND, YES, a Second Contest segment -- a gold price-guessing contest with STATEMENT!!!

The winner will be the entry closest to the settlement of the August futures contract (GC4Q) on the COMEX for Friday, June 25, 2004. All entries must be in Dollars and Tenths, posted by 12:00 Midnight Mountain time at the end of day, Tuesday, June 22, 2004.

Please indicate your POG Contest entry in the message subject box as follows:

$$$$Gold Price Guess$$$$

SUCH AS ---

$$$$$$$432.1$$$$$$$$

ALSO, --- Each POG guess must be accompanied by a brief statement on WHY you think gold is going to go where you think it is going.

=====

The following prizes, donated by Centennial Precious Metals, will be awarded.

For the Essay Contest

First prize is a highly collectible United States $10 gold Liberty coin in uncirculated grade, (0.48375oz. net fine gold)

Second prize is a Uruguay 5 peso gold coin (0.2501 net fine gold oz)

Third prize: A one ounce U.S. Silver Eagle.

===

For the GOLD Price-Guessing Contest

First prize is a Uruguay 5 peso gold coin (0.2501 oz. net fine gold)

Second and Third prizes shall be one each, a U.S. Silver Eagle.

On with the CONTEST and onward toward the prizes!! Good luck to all!!

For a new window to post your contest entry to the forum, click here. (Post a New Message)

What?! You don't have a password yet??! It couldn't be easier. Please review our Discussion Forum Guidelines page where you may register for your password. COME AND JOIN IN ON THE FUN ALL you lurkers!!

TWO-DAY SPECIAL -- Monday June 21st and Tuesday June 22nd. Take advantage of this summer solstice special and receive quarter-ounce uncirculated 1930 Uruguayan gold coins at quarter-ounce bullion pricing! For these two days only, volume incentives include Free Shipping, a Free Morgan Silver Dollar (VF/XF), a Free Proof 1986 US Silver Eagle... oh, and did we mention pre-1933 gold at bullion pricing? ...(

More)

TWO-DAY SPECIAL -- Monday June 21st and Tuesday June 22nd. Take advantage of this summer solstice special and receive quarter-ounce uncirculated 1930 Uruguayan gold coins at quarter-ounce bullion pricing! For these two days only, volume incentives include Free Shipping, a Free Morgan Silver Dollar (VF/XF), a Free Proof 1986 US Silver Eagle... oh, and did we mention pre-1933 gold at bullion pricing? ...(

More)

Gandalf the White

TA TA TAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA

YES, ALL -- Those were the CONTEST trumpets sounding again! A call to contest! A call to contest!

Knights and Ladies, consider this:

This month's National Geographic is preparing the public for the worst when it prints,

"Think gas is expensive now? Just wait. You've heard it before but this time its for real: We're at the beginning of the end of cheap oil."

Thanks to Sir Black Blade and others, we at the Table Round knew that someday this would be published to all ---

BUT, now let's take that a step further.

What will the end of cheap oil mean as a permanent state of affairs for the U.S. economy? For the world economy? What will it mean for gold?

So we'll make this a contest at two levels.

First, and most important, an "Essay Contest" answering the questions posed above. For the Essay entry, please indicate in the subject box as follows:

**** The End of Cheap Oil ****

(Just like that, surrounded by stars)

To qualify for contest entry, the Essay should be fifty or more words in length.

Essay Entry Deadline: NOON Denver time on Friday, June 25, 2004.

AND, YES, a Second Contest segment -- a gold price-guessing contest with STATEMENT!!!

The winner will be the entry closest to the settlement of the August futures contract (GC4Q) on the COMEX for Friday, June 25, 2004. All entries must be in Dollars and Tenths, posted by 12:00 Midnight Mountain time at the end of day, Tuesday, June 22, 2004.

Please indicate your POG Contest entry in the message subject box as follows:

$$$$Gold Price Guess$$$$

SUCH AS ---

$$$$$$$432.1$$$$$$$$

ALSO, --- Each POG guess must be accompanied by a brief statement on WHY you think gold is going to go where you think it is going.

=====

The following prizes, donated by Centennial Precious Metals, will be awarded.

For the Essay Contest

First prize is a highly collectible United States $10 gold Liberty coin in uncirculated grade, (0.48375oz. net fine gold)

Second prize is a Uruguay 5 peso gold coin (0.2501 net fine gold oz)

Third prize: A one ounce U.S. Silver Eagle.

===

For the GOLD Price-Guessing Contest

First prize is a Uruguay 5 peso gold coin (0.2501 oz. net fine gold)

Second and Third prizes shall be one each, a U.S. Silver Eagle.

On with the CONTEST and onward toward the prizes!! Good luck to all!!

For a new window to post your contest entry to the forum, click here. (Post a New Message)

What?! You don't have a password yet??! It couldn't be easier. Please review our Discussion Forum Guidelines page where you may register for your password. COME AND JOIN IN ON THE FUN ALL you lurkers!!

TWO-DAY SPECIAL -- Monday June 21st and Tuesday June 22nd. Take advantage of this summer solstice special and receive quarter-ounce uncirculated 1930 Uruguayan gold coins at quarter-ounce bullion pricing! For these two days only, volume incentives include Free Shipping, a Free Morgan Silver Dollar (VF/XF), a Free Proof 1986 US Silver Eagle... oh, and did we mention pre-1933 gold at bullion pricing? ...(

More)

TWO-DAY SPECIAL -- Monday June 21st and Tuesday June 22nd. Take advantage of this summer solstice special and receive quarter-ounce uncirculated 1930 Uruguayan gold coins at quarter-ounce bullion pricing! For these two days only, volume incentives include Free Shipping, a Free Morgan Silver Dollar (VF/XF), a Free Proof 1986 US Silver Eagle... oh, and did we mention pre-1933 gold at bullion pricing? ...(

More)

Gandalf the White

TA TA TAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA

YES, ALL -- Those were the CONTEST trumpets sounding again! A call to contest! A call to contest!

Knights and Ladies, consider this:

This month's National Geographic is preparing the public for the worst when it prints,

"Think gas is expensive now? Just wait. You've heard it before but this time its for real: We're at the beginning of the end of cheap oil."

Thanks to Sir Black Blade and others, we at the Table Round knew that someday this would be published to all ---

BUT, now let's take that a step further.

What will the end of cheap oil mean as a permanent state of affairs for the U.S. economy? For the world economy? What will it mean for gold?

So we'll make this a contest at two levels.

First, and most important, an "Essay Contest" answering the questions posed above. For the Essay entry, please indicate in the subject box as follows:

**** The End of Cheap Oil ****

(Just like that, surrounded by stars)

To qualify for contest entry, the Essay should be fifty or more words in length.

Essay Entry Deadline: NOON Denver time on Friday, June 25, 2004.

AND, YES, a Second Contest segment -- a gold price-guessing contest with STATEMENT!!!

The winner will be the entry closest to the settlement of the August futures contract (GC4Q) on the COMEX for Friday, June 25, 2004. All entries must be in Dollars and Tenths, posted by 12:00 Midnight Mountain time at the end of day, Tuesday, June 22, 2004.

Please indicate your POG Contest entry in the message subject box as follows:

$$$$Gold Price Guess$$$$

SUCH AS ---

$$$$$$$432.1$$$$$$$$

ALSO, --- Each POG guess must be accompanied by a brief statement on WHY you think gold is going to go where you think it is going.

=====

The following prizes, donated by Centennial Precious Metals, will be awarded.

For the Essay Contest

First prize is a highly collectible United States $10 gold Liberty coin in uncirculated grade, (0.48375oz. net fine gold)

Second prize is a Uruguay 5 peso gold coin (0.2501 net fine gold oz)

Third prize: A one ounce U.S. Silver Eagle.

===

For the GOLD Price-Guessing Contest

First prize is a Uruguay 5 peso gold coin (0.2501 oz. net fine gold)

Second and Third prizes shall be one each, a U.S. Silver Eagle.

On with the CONTEST and onward toward the prizes!! Good luck to all!!

For a new window to post your contest entry to the forum, click here. (Post a New Message)

What?! You don't have a password yet??! It couldn't be easier. Please review our Discussion Forum Guidelines page where you may register for your password. COME AND JOIN IN ON THE FUN ALL you lurkers!!

Gandalf the White

TA TA TAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAA

YES ALL -- Those were the CONTEST trumpets sounding again! A call to contest! A call to contest!

Knights and Ladies, consider this:

This month's National Geographic is preparing the

public for the worst when it prints,

"Think gas is expensive now? Just wait. You've heard it before but this time its for real: We're at the beginning of the end of cheap oil."

Thanks to Sir Black Blade and others, we at the Table Round knew that someday this would be published to all ---

BUT, now let's take that a step further.

What will the end of cheap oil mean as a permanent state of affairs for the U.S. economy? For the world economy? What will it mean for gold?

For this "Essay Contest", please answer the questions posed above. For the Essay entry, please indicate in the subject box as follows:

**** The End of Cheap Oil ****

**** The End of Cheap Oil ****

(Just like that, surrounded by stars)

To qualify for contest entry, the Essay should be fifty or more words in length.

Essay Entry Deadline: Denver time at NOON on Friday, June 25, 2004.

The following prizes, donated by USAGOLD-Centennial Precious Metals, will be awarded.

First prize is a highly collectible United States $10 gold Liberty coin in uncirculated grade, (0.48375 oz. net fine gold) Second prize is a Uruguay 5 peso gold coin (0.2501 net fine gold oz)

Second prize is a Uruguay 5 peso gold coin (0.2501 net fine gold oz)

Third prize: A one ounce U.S. Silver Eagle.

===

On with the CONTEST and onward toward the prizes. Good luck to all!!

For a new window to post your contest entry to the forum, click here. (Post a New Message)

What?! You don't have a password yet??! It couldn't be easier. Please review our Discussion Forum Guidelines page where you may register for your password. COME AND JOIN IN ON THE FUN ALL you lurkers!!

A picture may be worth a thousand words,

A picture may be worth a thousand words, "Without waxing philosophical, a few words are helpful concerning the mind-set with which you pursue your interest in gold ownership. Some enter the gold market to make a profit, others to hedge disaster, some to accomplish both. No matter into which category you fit, make sure you understand why you are going into the gold market. Convey that understanding to the individual with whom you are structuring your gold portfolio. The whys have quite a bit to do with what you end up owning.

"Without waxing philosophical, a few words are helpful concerning the mind-set with which you pursue your interest in gold ownership. Some enter the gold market to make a profit, others to hedge disaster, some to accomplish both. No matter into which category you fit, make sure you understand why you are going into the gold market. Convey that understanding to the individual with whom you are structuring your gold portfolio. The whys have quite a bit to do with what you end up owning.

"Frequently investors will say that any kind of gold will do because after all gold is gold, isn't it? This type of attitude has helped a great many coin shop owners unload unwanted inventory they hadn't been able to get rid of for years. This is probably a good deal for the coin dealer, but it could spell disaster for you. In the same vein, I have talked to hundreds, probably thousands, of investors in nearly a quarter century in the business. Quite often, potential investors have no more reason for buying gold than 'everybody else is doing it.'

"In Chapter 16 on portfolio planning, you will find some details on this important subject. For now, consider the inscription over the entrance to the temple of the ancient Delphic Oracle: 'Know Thyself.' Study. Read. Learn what's going on around you. Call a few gold firms and ask questions. There's nothing like conversation to stimulate thinking. Take time to lay a little groundwork. Then make your move. The political and economic situation being what it is, there is no better time to start than now. Know thyself -- your goals and needs -- and you will be a more confident, happier gold investor." (more)

Please Remember: It is your purchase from USAGOLD - Centennial Precious Metals that nourishes these pages.

The USAGOLD logo and stylized gold coin pile are trademarks of Michael J. Kosares.

© 1997-2012 Michael J. Kosares / USAGOLD All Rights Reserved

Attacks on the USA installations and oil supply should be understood as reprisals against those who run the present US government, and not against the people of the US, who have to do what the government orders them to do.

It is hard for most people to make a distinction between an act of war against their rulers as something different from an attack against themselves personally.

The policies of the present administration have been a total disaster for the USA, which finds itself in almost complete isolation from the sympathy and credibility of the rest of the world. All possibility of world leadership has been forfeited by Bush Jr. and his neocon masters. Most Americans do not seem to understand that that is the way the rest of the world regards them today: the USA is THE rogue nation.

Other powers are prudently going along with the USA so as not to aggravate matters, but the situation is one of isolation of the USA into itself in a kind of "ghetto policy" taken from the neocons, themselves Jewish, who are doing the same for Israel - building a ghetto wall around the country. This idea of retreating into a ghetto for the Chosen People, comes from those who exercise power today in the USA, that is their mindset.

When the financial breakdown brings crashing down all hopes of mastery through military might - military might takes money, the REAL STUFF, not paper you know, to keep it going - then the desperate men who are shamefully using the USA to bring about their own ends, will likely go crazy and stop at nothing, not even nuclear war. They have even said so.

The problem is not in objects from outer space, it is from our own human conflicts and the unlimited lust for power.

Save some real money, stock up on necessaries, get out of debt, and don't forget to PRAY A LOT. We are all going to need God's help in the coming debacle.

Sorry for this gloomy tone, but the GAB has a service to do, and it cannot be done without speaking the FULL TRUTH, as the GAB sees it.

The GAB